36+ Mortgage calculator with state taxes

85436 Balloon Payment Amount Loan Amount Total Interest. This is the cost of the home minus the down payment.

This Is A Question That Remains Ever Popular Among Home Buyers Closing Costs Are The Fees Associate Real Estate Infographic Buying First Home Real Estate Tips

The 2836 rule may help you decide how much to spend on a home.

. The mortgage calculator with taxes and insurance allows a borrower to include property taxes and homeowners insurance so that one can get a complete. The main reason home loan calculators ask for your zip code is so they can estimate your property taxes. The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage.

Sale Price - Down Payment. You have to pay taxes and insurance on your house. Taxes vary by state and may.

The Mortgage Bankers Asociations chief economist Mike Fratantoni believes the 30-year fixed rate will reach 33 in 2021 and 36 in 2022. Check the IRS website for the latest information about income taxes and your state tax website for state-specific information. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors.

Taxes and insurance vary state by state and city by city. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Our free mortgage calculator gives you an idea of how much you can expect to pay for a mortgage in 2022.

On top of that bill youll have to consider property taxes and homeowners insurance as two more recurring expenses. Property taxes in California are a relative bargain compared to the rest of the nation. Fannie Mae chief economist Doug Duncan believes the 30-year fixed rate will be 28 through 2021 and reach 29 in 2022.

To be paid each month. Factors in Your California Mortgage Payment. Other loan programs are available.

Use SmartAssets free Texas mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more. This will be the only land payment calculator that you will ever need whether you want to calculate payments for residential or commercial lands. Most lenders and calculators evaluate affordability with the 2836 rule which establishes that your housing expenses and total.

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Lenders look most favorably on debt-to-income ratios of 36 or less or a maximum of 1800 a. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI. Fortunately Texas is one of the few states that doesnt levy transfer taxes or include a state recordation tax which will save you a percentage of overall costs. See how changes affect your monthly payment.

Actual payment could include escrow for insurance and property taxes plus private mortgage insurance PMI. Using our mortgage rate calculator with PMI taxes and insurance. For example lets say youre considering purchasing a 250000 home and putting 20 percent down.

Check the IRS website for the latest information about income taxes and your state tax website for state-specific information. When the Federal State Reserve decided to lower interest rates in response to the coronavirus pandemic. Mortgage calculator results are based upon conventional program guidelines.

Your monthly mortgage payment will consist of your mortgage principal and interest. Get a clear breakdown of your potential mortgage payments with taxes and insurance included. To the 2836 rule which says to not spend more than 28 of your gross monthly income on housing expenses and only 36 of your income on.

Start by entering the mortgage amount. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income. The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt.

2021 2022 Mortgage Rate Housing Market Predictions Mortgage Rates.

30 Best Business Accountants Bookkeepers In Richmond Melbourne 2022

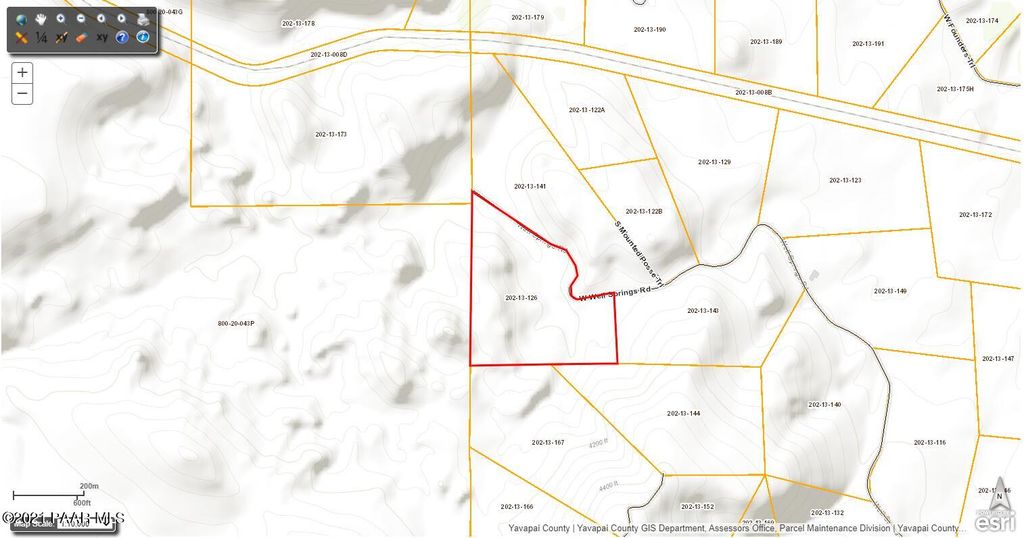

W Well Springs Rd Kirkland Az 86332 Trulia

305 N Demorest Street Belding Mi 48809 Home For Sale Mls 22032298 Real Estate One

Jayson Bates On Twitter Financial Aid For College Tax Software Tax Deductions

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

25 Best Business Accountants In Oakleigh Victoria 2022

Vt Route 30 North Pawlet Vt 05761 Mls 4877774

W Lonely Dove Pl 17 Huachuca City Az 85616 Mls 22212439 Trulia

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax

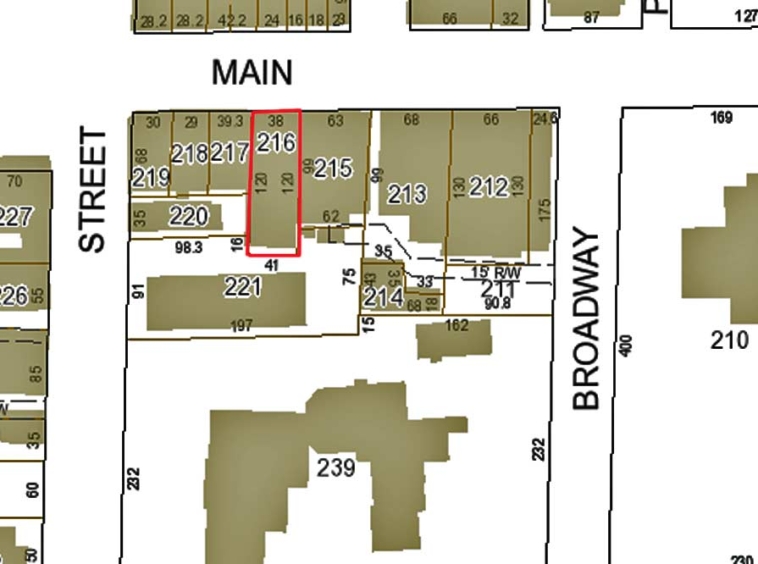

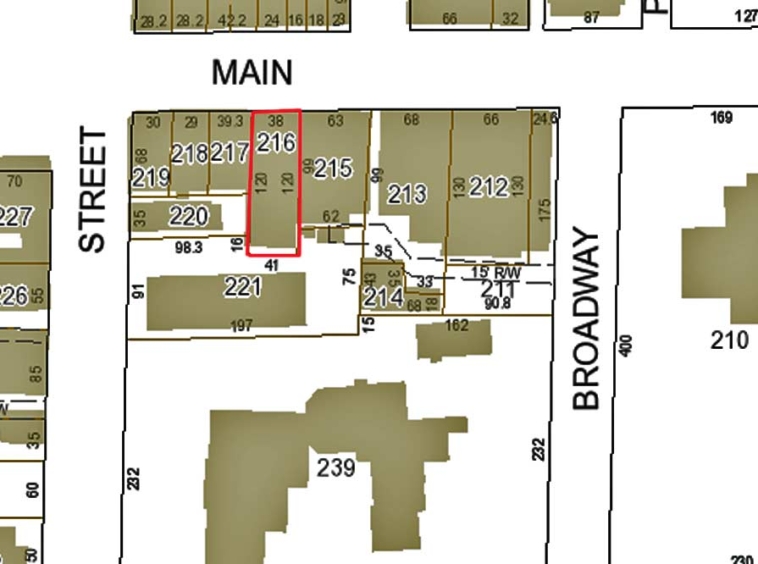

59 61 Main Streets Houlton Me Mooers Realty

3960 Utah Street San Diego Ca 92104 Compass

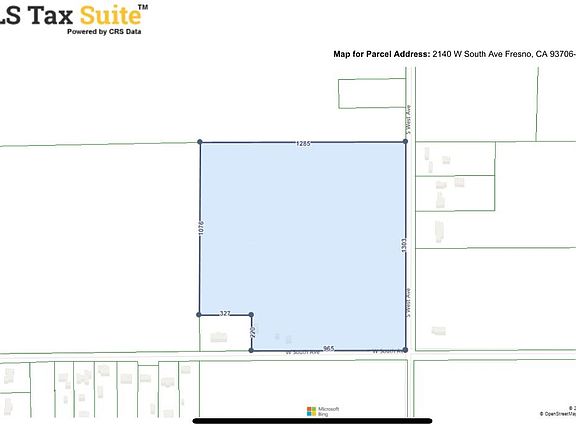

2140 W South Ave Fresno Ca 93706 Mls 579553 Zillow

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

2

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Take These 5 Steps For A Quicker And Bigger Tax Refund In 2022 Barron S Tax Preparation Tax Preparation Services Tax Services

Northport Maine Real Estate Re Max Jaret Cohn